Credit Repair Compliance Orientation

Welcome to the Credit Repair Compliance Orientation course at Credzu University.

Rather than diving into the depth of particular laws and rules like the Credit Repair Organizations Act or the credit repair provision of the Telemarketing Sales Rule, we will look at the concept of compliance, generally, for the purpose of understanding:

- The origin of regulations and why they exist.

- The benefit of compliance.

- The consequence of noncompliance.

Credit repair organizations are subject to laws and regulations at the federal, state, and local levels. These laws and regulations are designed to protect consumers by ensuring that credit repair organizations operate lawfully, fairly, and transparently. In other words, these laws and regulations are designed to prevent credit repair organizations from engaging in unfair, deceptive, or abusive practices.

This course is designed to give you a broad understanding of compliance, how it affects your business as a credit repair organization, and how to develop systems and processes to ensure that your organization complies with the law.

All credit repair companies should take this free course to orient themselves to compliance concepts and spark curiosity about the laws that regulate the industry. The journey to legal operational practices begins here.

Introduction to this course.

One of the instructors welcomes you to the course and talks about the introductory lessons.

Before you take a course, you'll likely want to know what it's about. This lesson goes over and sets the anticipated outcomes you can expect by taking it.

It's important to distinguish between legal advice on which you can rely and education that prepares you to engage with a lawyer. This disclosure course explains the difference so you understand that Credzu University does not provide tax, legal or financial advice.

If you're going to take a course, you might also want to know a bit about those teaching it. This lesson introduces you to Robert Sigman and Cory Miller from Credzu. And, it explains a bit why you might want to consider their perspective on compliance issues.

This quiz evaluates your understanding from the lessons in section one of the credit repair compliance orientation course.

Introduction to this course.

One of the instructors welcomes you to the course and talks about the introductory lessons.

Before you take a course, you'll likely want to know what it's about. This lesson goes over and sets the anticipated outcomes you can expect by taking it.

It's important to distinguish between legal advice on which you can rely and education that prepares you to engage with a lawyer. This disclosure course explains the difference so you understand that Credzu University does not provide tax, legal or financial advice.

If you're going to take a course, you might also want to know a bit about those teaching it. This lesson introduces you to Robert Sigman and Cory Miller from Credzu. And, it explains a bit why you might want to consider their perspective on compliance issues.

This quiz evaluates your understanding from the lessons in section one of the credit repair compliance orientation course.

Understanding compliance.

This lesson talks about the origins of compliance, in general. This helps understand later lessons about credit repair compliance.

Before getting into details, we give an overview of compliance so that everything else makes sense in this context.

This lesson explains a very important concept; Bad corporate behavior leads to regulation.

The rules apply to everyone, including the government. Regulation also needs to be regulated. This lesson explains why and gives a few examples.

The problem in our industry is that we're closer to 0% compliant than 100% compliant. Our goal is to move that pendulum as far away from 0% and as close to 100% as possible.

This quiz evaluates your understanding of compliance, generally (not specific to any particular law or rule).

Understanding compliance.

This lesson talks about the origins of compliance, in general. This helps understand later lessons about credit repair compliance.

Before getting into details, we give an overview of compliance so that everything else makes sense in this context.

This lesson explains a very important concept; Bad corporate behavior leads to regulation.

The rules apply to everyone, including the government. Regulation also needs to be regulated. This lesson explains why and gives a few examples.

The problem in our industry is that we're closer to 0% compliant than 100% compliant. Our goal is to move that pendulum as far away from 0% and as close to 100% as possible.

This quiz evaluates your understanding of compliance, generally (not specific to any particular law or rule).

The origins of credit repair regulations.

This video explains, quickly, the history of consumer harm that lead to credit repair regulations.

This lesson reviews a quick but informative history of consumer harm in the credit repair industry.

Credit repair regulation was a reaction to consumer harm in the credit repair industry.

Lawsuits against credit repair companies are on the rise. This lesson discusses that trend.

This quiz is a little bit more specific than previous quizzes. And, it's a little more subjective, too. We want to see if you can respond not just to content but to concepts, as well.

The origins of credit repair regulations.

This video explains, quickly, the history of consumer harm that lead to credit repair regulations.

This lesson reviews a quick but informative history of consumer harm in the credit repair industry.

Credit repair regulation was a reaction to consumer harm in the credit repair industry.

Lawsuits against credit repair companies are on the rise. This lesson discusses that trend.

This quiz is a little bit more specific than previous quizzes. And, it's a little more subjective, too. We want to see if you can respond not just to content but to concepts, as well.

Examples of credit repair regulations.

This lesson outlines the major laws and rules that are directed toward the credit repair industry.

This lesson introduces you to the Federal Trade Commission Act.

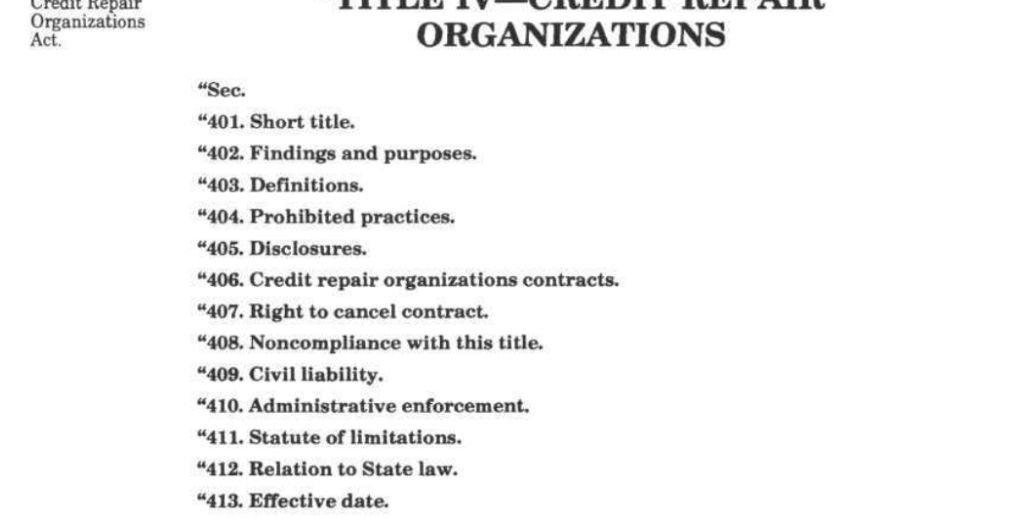

This lesson explores the most important credit repair law, the Credit Repair Repair Organizations Act.

This course covers the fact that, in addition to federal credit repair laws and rules, there are state-specific laws and rules for credit repair companies.

The Telemarketing Sales Rule imposes severe restrictions (including a 6-month delay in payment) on credit repair companies.

This lesson covers what you need to know concerning the Telephone Consumer Protection Act.

This quiz tests your knowledge of the laws and rules we introduced you to in this lesson.

Examples of credit repair regulations.

This lesson outlines the major laws and rules that are directed toward the credit repair industry.

This lesson introduces you to the Federal Trade Commission Act.

This lesson explores the most important credit repair law, the Credit Repair Repair Organizations Act.

This course covers the fact that, in addition to federal credit repair laws and rules, there are state-specific laws and rules for credit repair companies.

The Telemarketing Sales Rule imposes severe restrictions (including a 6-month delay in payment) on credit repair companies.

This lesson covers what you need to know concerning the Telephone Consumer Protection Act.

This quiz tests your knowledge of the laws and rules we introduced you to in this lesson.

Examples of Non-Compliant Practices

This lesson explores the consequences of non-compliance with credit repair laws.

This is a very important lesson (probably the most important lesson) concerning misrepresentations.

This lesson explores the importance of establishing an entity and other technical compliance considerations.

This lesson covers requirements to safeguard and retain records.

This lesson discusses the many laws and rules which prohibit advanced fees in credit repair services.

This lesson discusses easy to comply with but often violated credit repair rules.

This lesson discusses potential fraud in the credit repair space.

This lesson explains why loopholes don't work in credit repair.

Examples of Non-Compliant Practices

This lesson explores the consequences of non-compliance with credit repair laws.

This is a very important lesson (probably the most important lesson) concerning misrepresentations.

This lesson explores the importance of establishing an entity and other technical compliance considerations.

This lesson covers requirements to safeguard and retain records.

This lesson discusses the many laws and rules which prohibit advanced fees in credit repair services.

This lesson discusses easy to comply with but often violated credit repair rules.

This lesson discusses potential fraud in the credit repair space.

This lesson explains why loopholes don't work in credit repair.

Consequences for noncompliance.

This lesson explores the consequences of non-compliance with credit repair laws.

This lesson observes that embarrassment is one consequence for non-compliance with credit repair laws.

This lesson explores the burdens associated with non-compliance with credit repair laws and rules.

This lesson discusses injunctions for non-compliance with credit repair laws and rules.

This lesson discusses fines and penalties for credit repair violations.

This lesson discusses how you could lose personal assets for violation of credit repair laws and rules.

This lesson covers fraudulent practices in credit repair that can land you in jail.

This quiz tests your knowledge on the consequences of non-compliance.

Consequences for noncompliance.

This lesson explores the consequences of non-compliance with credit repair laws.

This lesson observes that embarrassment is one consequence for non-compliance with credit repair laws.

This lesson explores the burdens associated with non-compliance with credit repair laws and rules.

This lesson discusses injunctions for non-compliance with credit repair laws and rules.

This lesson discusses fines and penalties for credit repair violations.

This lesson discusses how you could lose personal assets for violation of credit repair laws and rules.

This lesson covers fraudulent practices in credit repair that can land you in jail.

This quiz tests your knowledge on the consequences of non-compliance.

Benefits of compliance.

This lesson discusses the benefits of compliance with credit repair laws.

Compliance with regulations leads to a good reputation.

This lesson explains how compliance with credit repair laws builds trust.

This lesson explains that an increase in compliance reduces regulatory risk.

This quiz tests your knowledge of compliance benefits.

Benefits of compliance.

This lesson discusses the benefits of compliance with credit repair laws.

Compliance with regulations leads to a good reputation.

This lesson explains how compliance with credit repair laws builds trust.

This lesson explains that an increase in compliance reduces regulatory risk.

This quiz tests your knowledge of compliance benefits.

Compliance options.

This lesson discusses credit repair legal compliance options.

This lesson discusses when it's appropriate to exit the credit repair industry.

This lesson explains the benefits of surrounding yourself with compliance-minded people.

This lesson restates the need to avoid loopholes and those advocating them.

This lesson discusses compliance platforms as an option for credit repair companies.

Compliance options.

This lesson discusses credit repair legal compliance options.

This lesson discusses when it's appropriate to exit the credit repair industry.

This lesson explains the benefits of surrounding yourself with compliance-minded people.

This lesson restates the need to avoid loopholes and those advocating them.

This lesson discusses compliance platforms as an option for credit repair companies.